Overview

Are you worried about keeping your job in COVID-19? This blog will go though the steps that you need so that you know how to safeguard your job during this crisis.

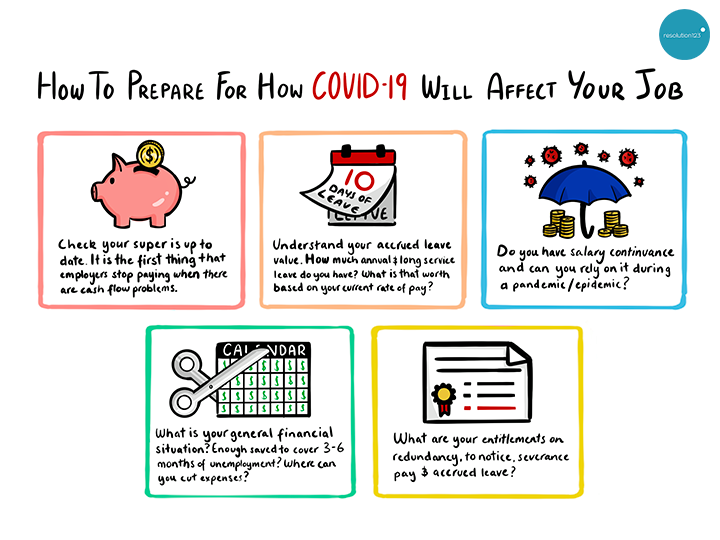

Check Your Super and Leave Entitlements

Is your super up to date? If it’s not, inquire into that. It’s the first thing that employers don’t pay when your employer is in real trouble.

Check your accrued leave entitlements. If you do not know how much you have accrued in annual leave, personal leave and long service leave, go and check that now. Download all of your payslips from your employer system into your personal system so that you have a record. Check what they say and check whether or not they make it clear to you what your leave accruals are and what they are valued at today. If you can’t get that information, make a request for that information. They’re required to keep that information at law. They’ve got a right to make a request under the Fair Work Act for that information.

If you want to check what your annual leave or long service leave accruals should be, then you can use the Fair Work Ombudsman’s pay and conditions tool. It will help you calculate your legal entitlements.

Salary Continuance and Insurance During COVID-19

Do you have salary continuance insurance and in what circumstances will that insurer pay out that insurance? Some of you might have taken out personally, some of you might have that entitlement arising from an award. Would it apply in a stand-down scenario or if you’re made redundant. And does it apply that we are going through a pandemic? Many insurance policies have a general exclusion for that type of scenario.

Savings and Entitlements

To use Barefoot Investor terminology, do you have a Mojo account and how much is in it? His strategy is to put away at least three months of savings to cover all your expenses. What are your expenses? What can you cut back now? And how much do you have in savings? How much can you save over this period of time?

If you lose my job, are you entitled to notice? You need to check your terms of employment and your award/enterprise agreement. At the bare minimum, you are entitled to notice in accordance with the National Employment Standards. You can use the pay and conditions tool to work out that notice period.

Equally, do you have an entitlement to redundancy pay? Under the Fair Work Act, if you are employed by a small business, which is an employer that has under 15 employees, you are not entitled to redundancy pay unless you have an entitlement under your contract.

Next Steps

Check out the Fair Work Commission’s comprehensive list that outlines all the changes that are happening to the workplace as a result of COVID-19 right here.